How does the economy look to you?

Do you feel like the economy isn’t making a lot of sense right now?

Is there a mismatch between the headlines and your perception?

If so, you’re not alone.

There’s a big divide between the current data and the “vibes” many Americans are feeling.

Here’s what I mean -

When you look at the data, the economy is actually looking pretty good.

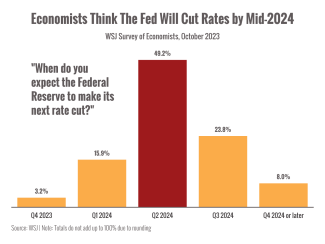

Many economists think the Fed will be able to cut interest rates by mid-2024.1

The labor market is surprisingly strong, adding 336,000 jobs in September, up significantly from the 200,000+ added in both July and August.2

Manufacturing, which slowed earlier in the year, looks to be rebounding as factory output rises.3

And Americans are still spending online, in stores, and in restaurants.2

Right when a lot of analysts worried we’d see a slowdown.

In fact, the estimates for Q3 economic growth look downright rosy.4

But why does it feel like the economy is teetering?

When it comes to the economy, the data and our perceptions often don’t match.

I think that’s for a few reasons.

- Humans come with an inborn negative bias. Our brains are wired with a "positive-negative asymmetry," which means we tend to remember negative news and react more strongly to negative stimuli.

- Our circumstances impact our perception. If you’ve gone through a layoff or are watching folks around you struggle, it’s going to give you a different perspective on the economy.

- We keep seeing headlines about the "uncharted waters" we're swimming in. The pandemic upended everything and we're still feeling the effects.

All told, there are a number of reasons why you might not feel positive about the economy.

There are definitely potential headwinds ahead for the economy. There always are.

The wars in Israel and Ukraine inject pain and uncertainty.

The excess savings Americans built up during the pandemic have largely been spent, which could slow future spending.5

The effects of high interest rates are still percolating throughout the economy. It’s not clear that we’ve seen the full effects yet.

A rising number of subprime borrowers are late with their loan payments.6

Bottom line: The U.S. economy is still going strong from where the data stands, but it's not surprising if the “vibes” don't match.

What's important is staying flexible and acting with confidence, not fear.

I’m watching the data closely. Don’t hesitate to contact me if I can be of any assistance.

Sources

1. https://www.wsj.com/economy/a-recession-is-no-longer-the-consensus-3ad0c3a3

2. https://www.wsj.com/economy/the-economy-was-supposed-to-slow-by-now-instead-its-revving-up-3c0f7a2e

3. https://www.federalreserve.gov/releases/g17/current/default.htm

4. https://www.atlantafed.org/cqer/research/gdpnow

Chart source: https://www.wsj.com/economy/a-recession-is-no-longer-the-consensus-3ad0c3a3

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.